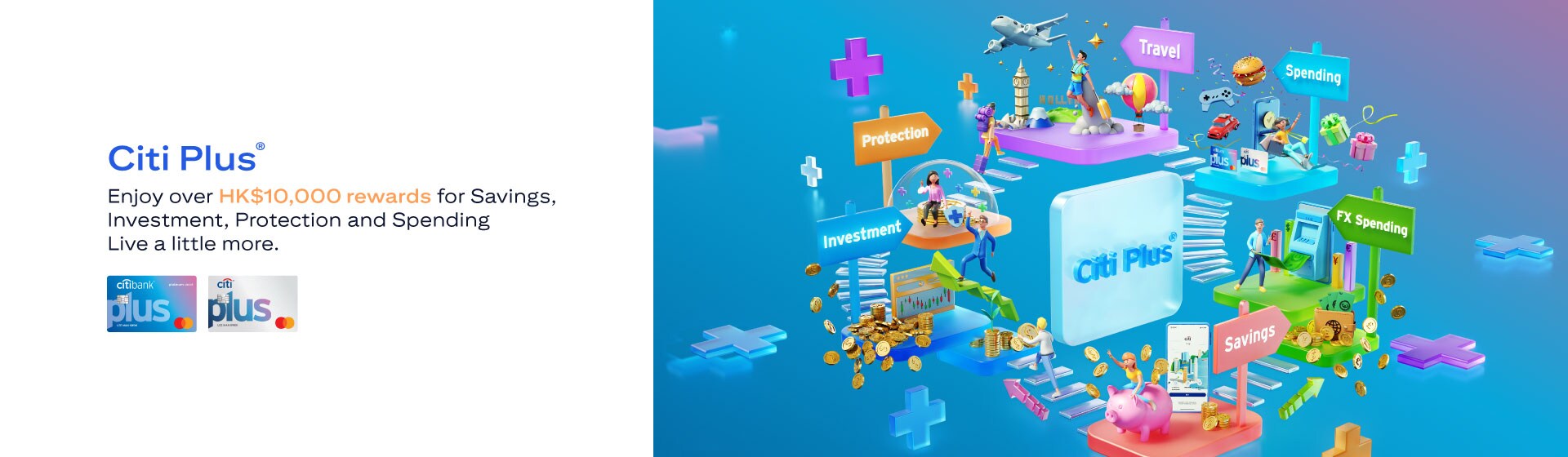

With Citi Plus®, you can always level up your wealth with our comprehensive wealth solutions – from savings, investment and protection to spending. Planning for your year-end vacation? Enjoy Citi Plus® perks to cover air ticket and hotel bookings before your trip, foreign currency exchange, to overseas withdrawals and spending. Expand your horizons with Citi Plus®. Live a little more.

first policy year upon successful

application for Zurich Lifestyle

Insurance Plan.

Click HERE to learn more

Upon successful application for

Zurich FlyAway Travel Insurance Plan to enjoy:

30% off on Single Travel Insurance Plan

20% off on Annual Travel Insurance Plan

Citi Plus® also provides you

with other insurance coverage.

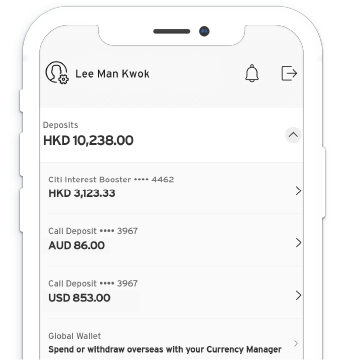

extra savings rate up to 1.5% p.a.

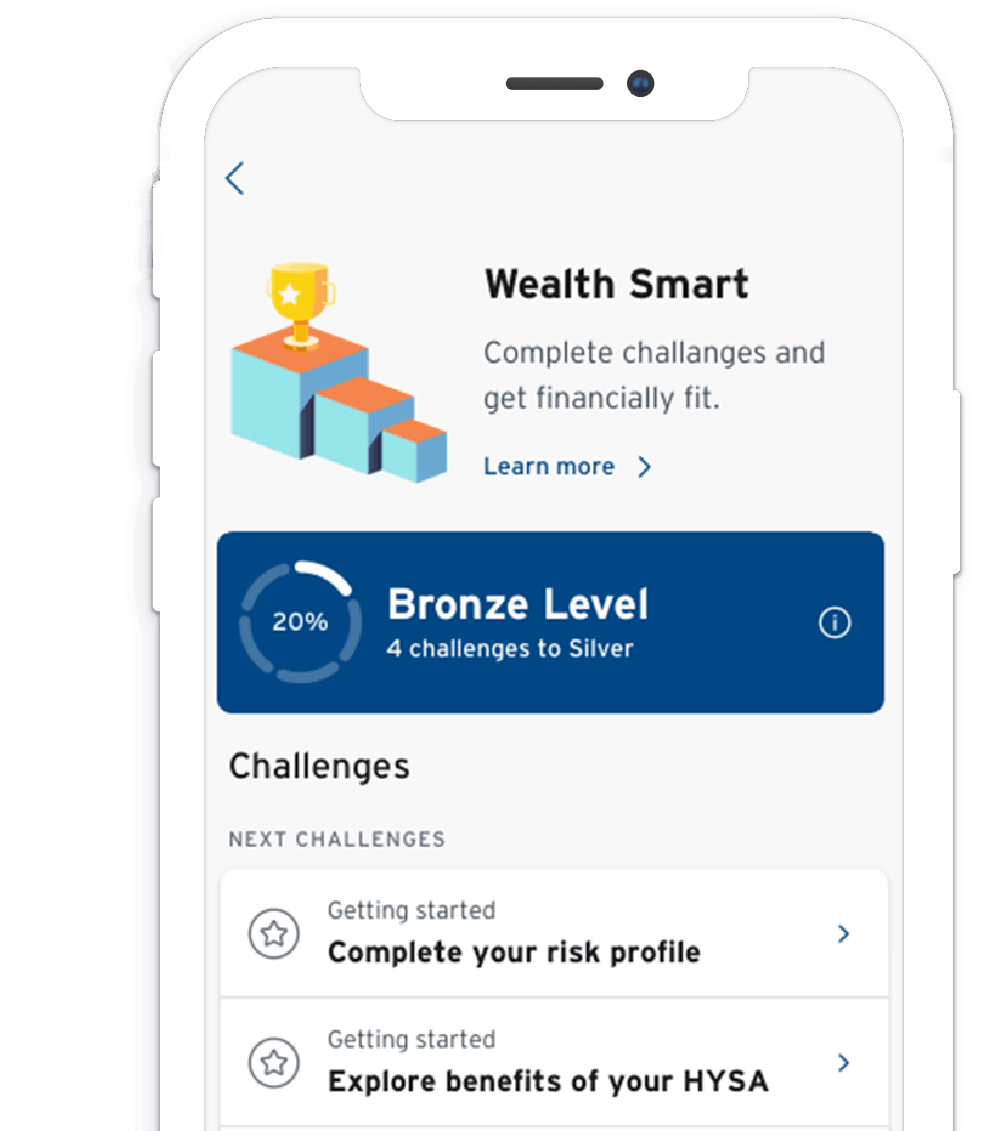

What’s more, earn up to

extra 1.5% p.a. interest on savings

by completing simple missions

The interest rate of Citi Interest Booster will be determined by the Bank from time to time.

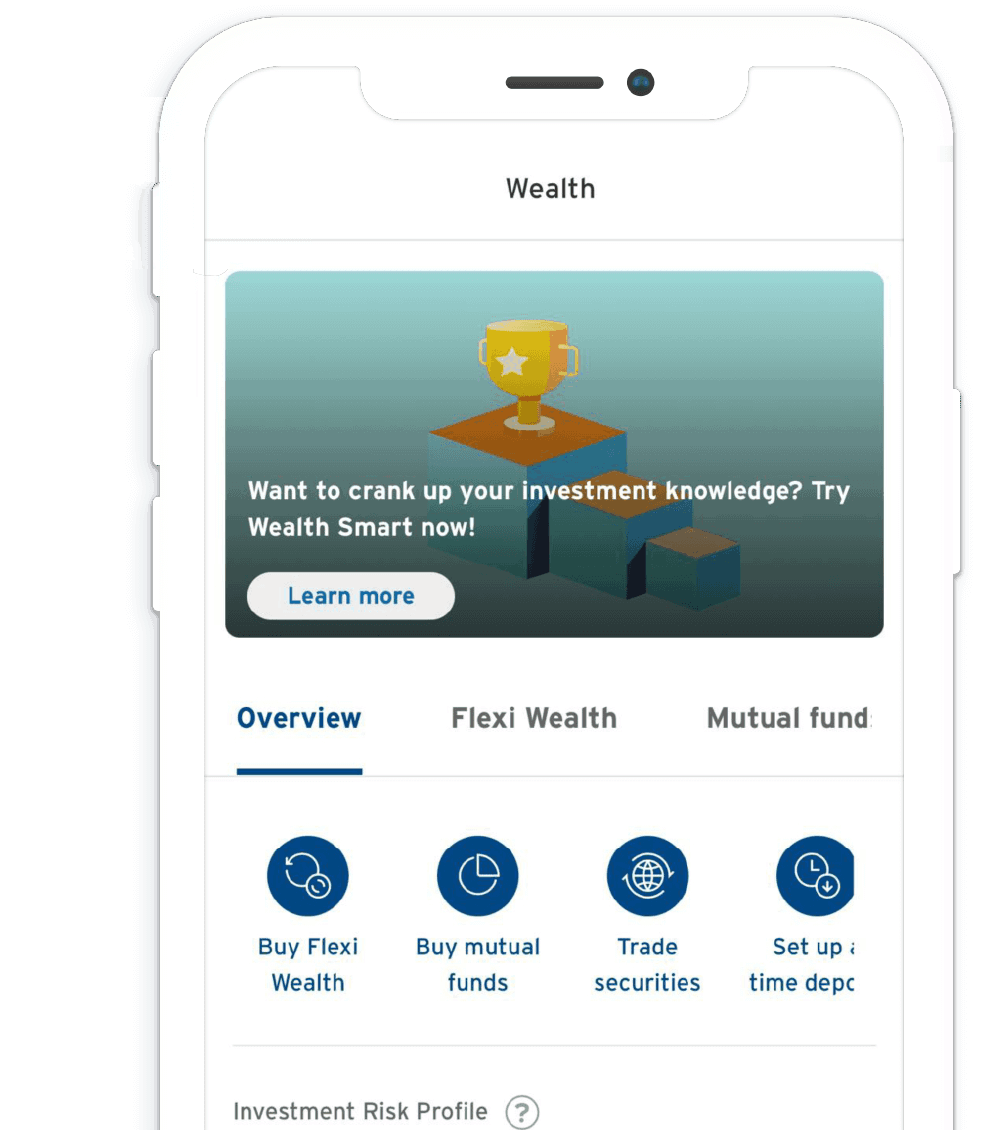

with your Investment Playlist

First 3 Months

Cash rebate up to HK$1,600